Download Alert: This Genius App Will Change the Way You Buy a Car (It's So Easy)

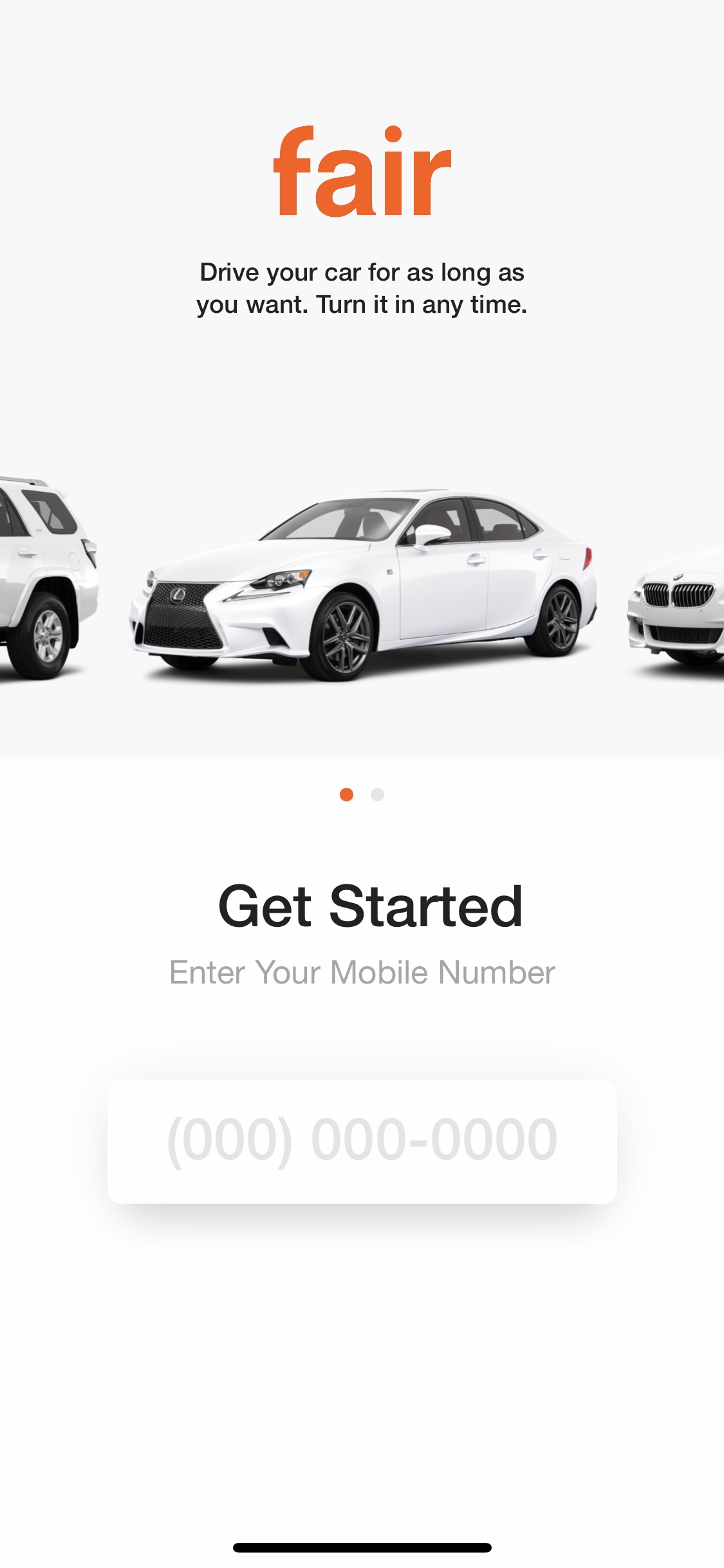

Say hello to Fair.

This post is in partnership with Fair.

Photo: Courtesy of Create & Cultivate

Making big decisions isn’t easy. Especially the ones that involve long term commitments—like picking a new home, selecting a new job, and buying a new car. These decisions hold a lot of weight because of their lengthy processes and the anticipation of commitment. Even if you’re not a “commitment-phobe”, there’s always a lot to consider before spending a significant amount of your hard-earned money.

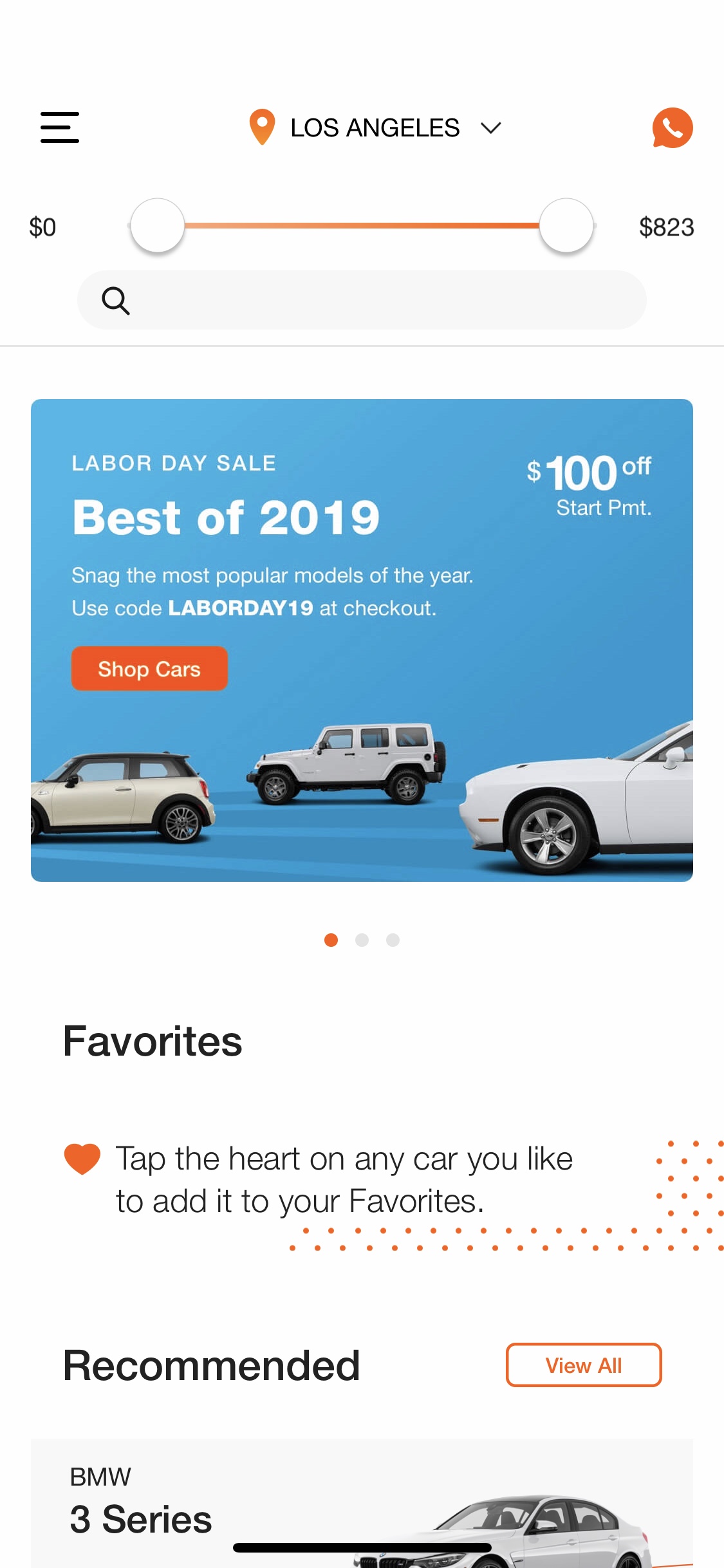

If only the "big” decision-making processes were made easier, then the stress tied to them would lessen, and the barriers to entry would also be lowered—that’s the ideal combination, right? Well, in our quest to simplify, we came across a solution for one big decision we all dread: buying a car. Skip the fluorescently-lit car dealerships with their burnt coffee and long wait times—the answer is in the palm of your hand—say hello to Fair.

Fair is the new subscription service that is changing the way we buy cars. This easy-to-use app allows you to find the used car you’ve always dreamed of in one convenient app. You can buy a car without even having to leave the comfort of your couch and it takes the commitment out of the car-buying process (you can kiss car loans and leases good-bye!).

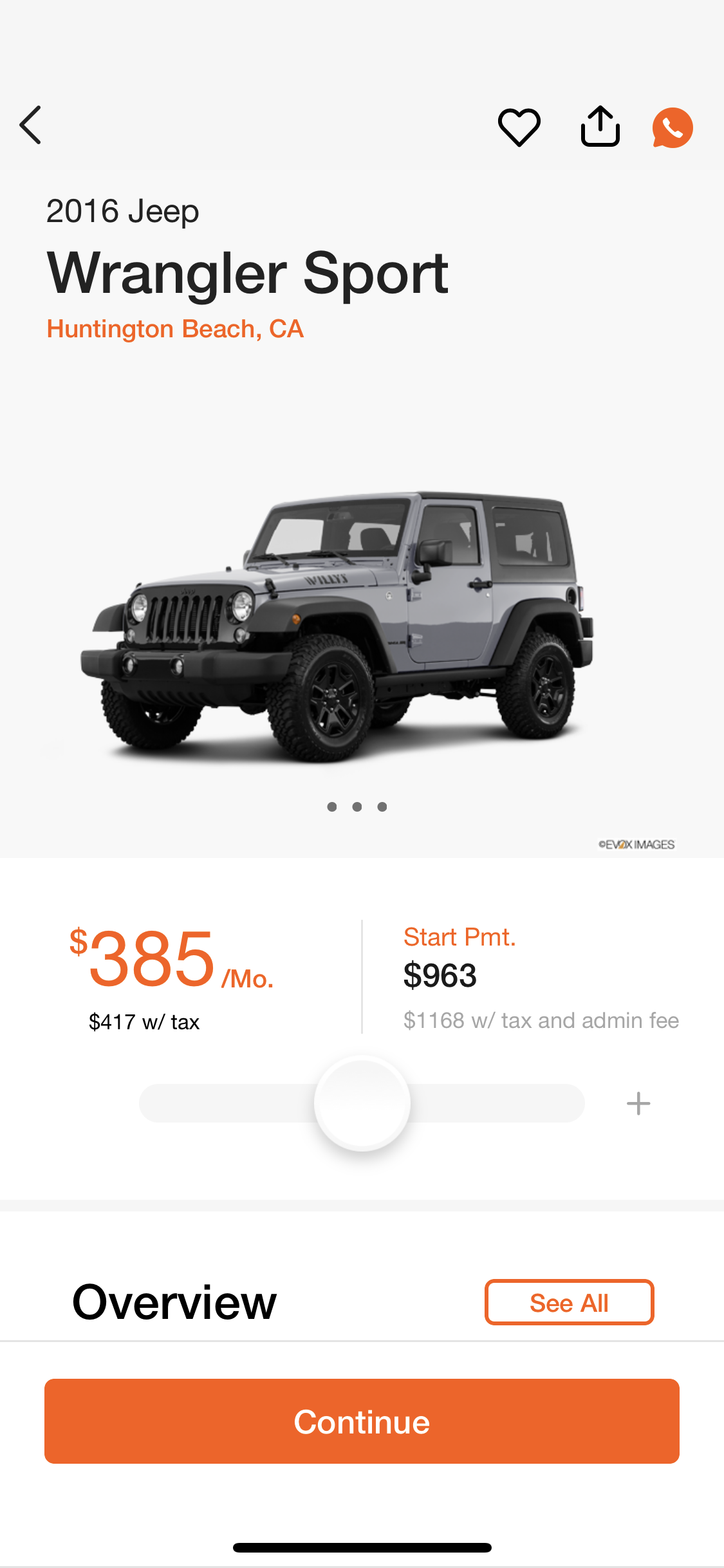

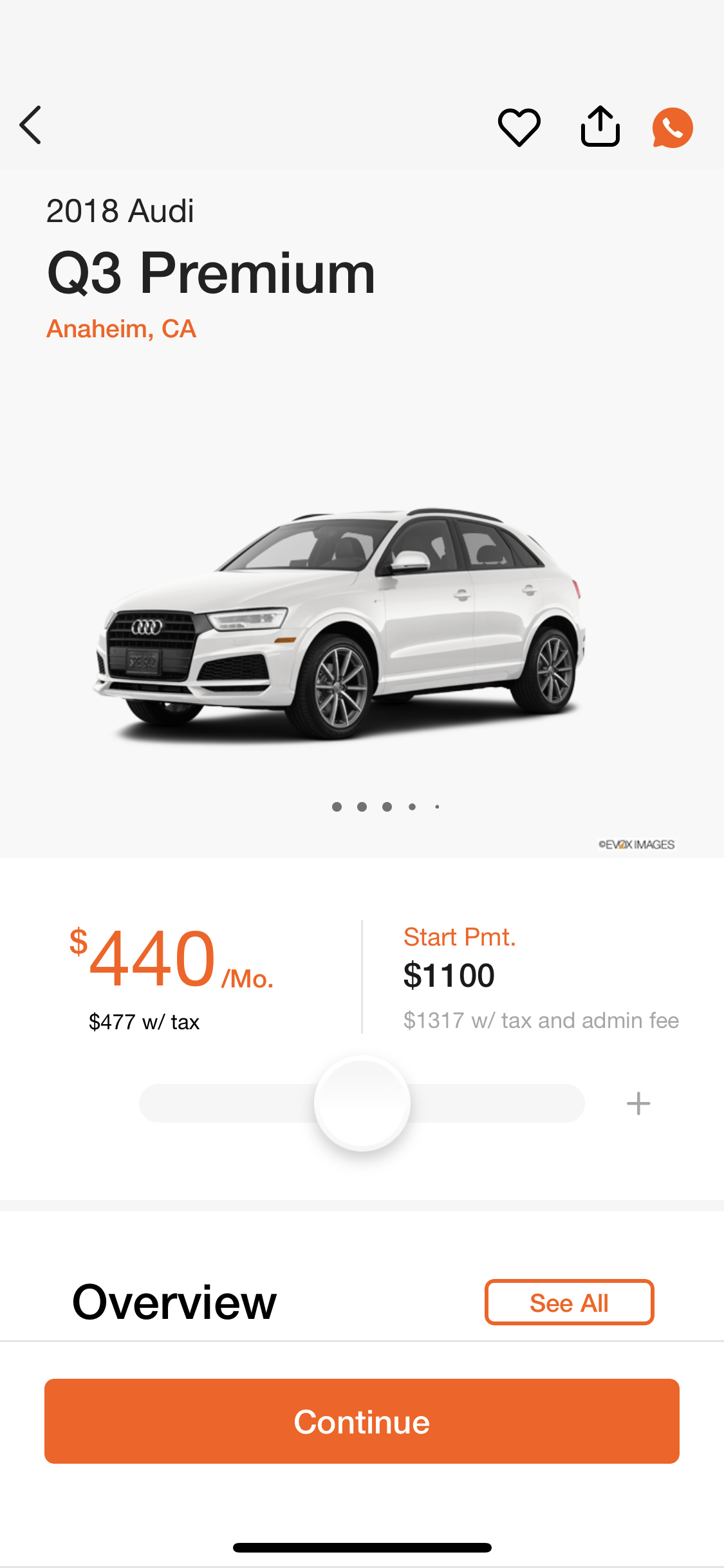

Fair’s version of car buying really lives up to its name. Now you’ll never be stuck with a car past its expiration date. Bottom line: you can get a car when you want, for as long as you want, and turn it back in at any time—no strings attached. Sounds too good to be true, we know.

But just when you thought it couldn’t get any better, we’re going to remind you that a Fair subscription includes a limited warranty, roadside assistance, and routine maintenance too. Is this deal not sweet enough for you? How about this: when you get a car to drive for Uber, you pay even less. Crazy right? Well, let’s take you through the app’s interface to show you how good life can be as a Fair user.

Here’s how it works:

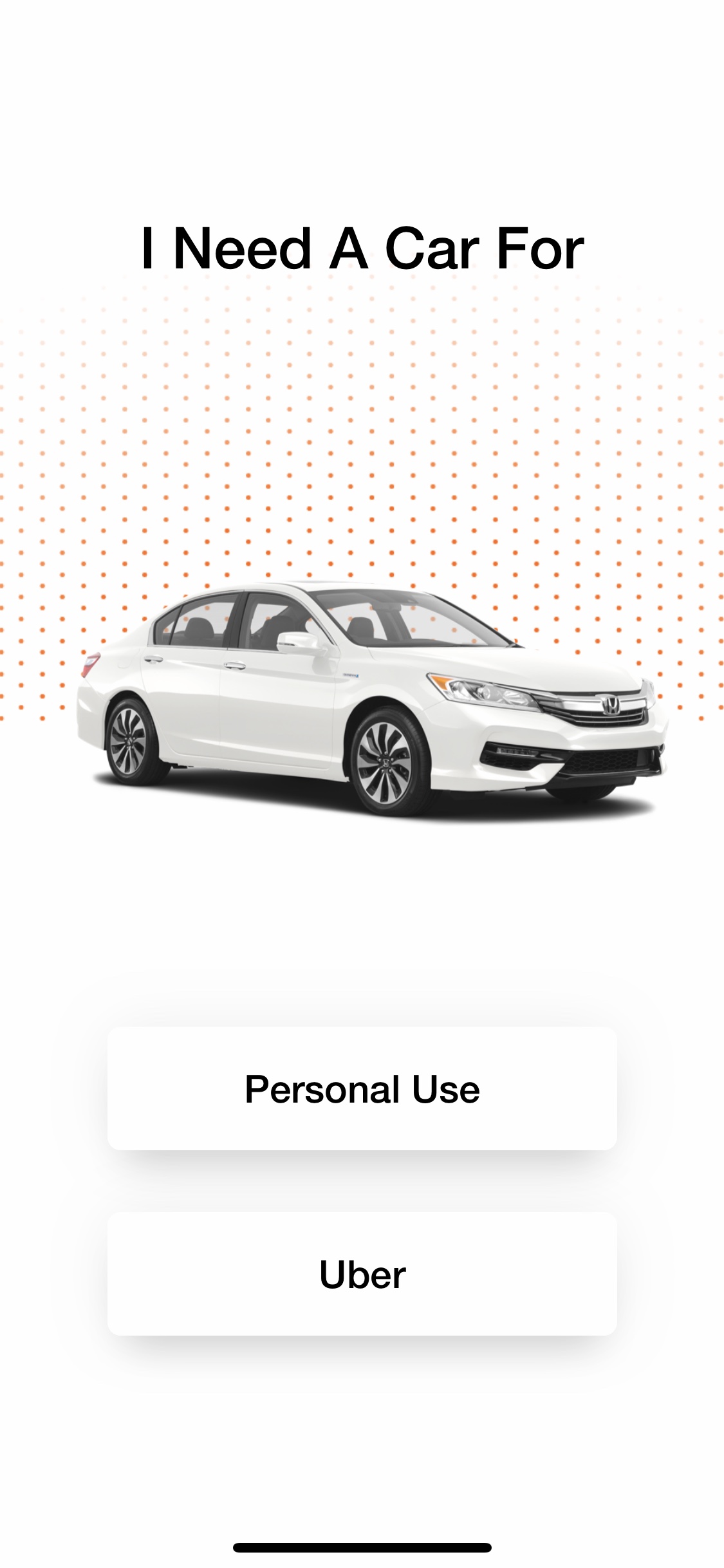

Step 1: Download the app and pick your use preference

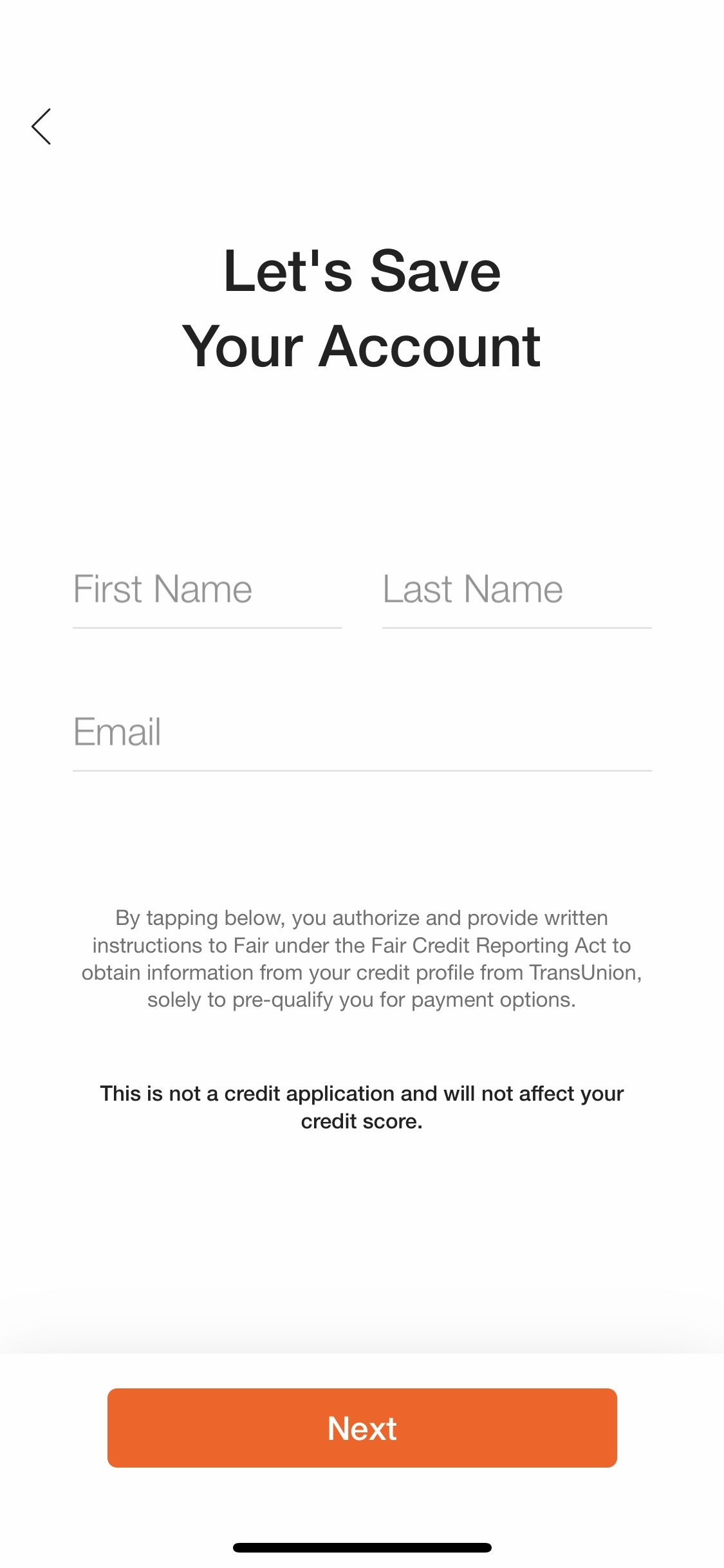

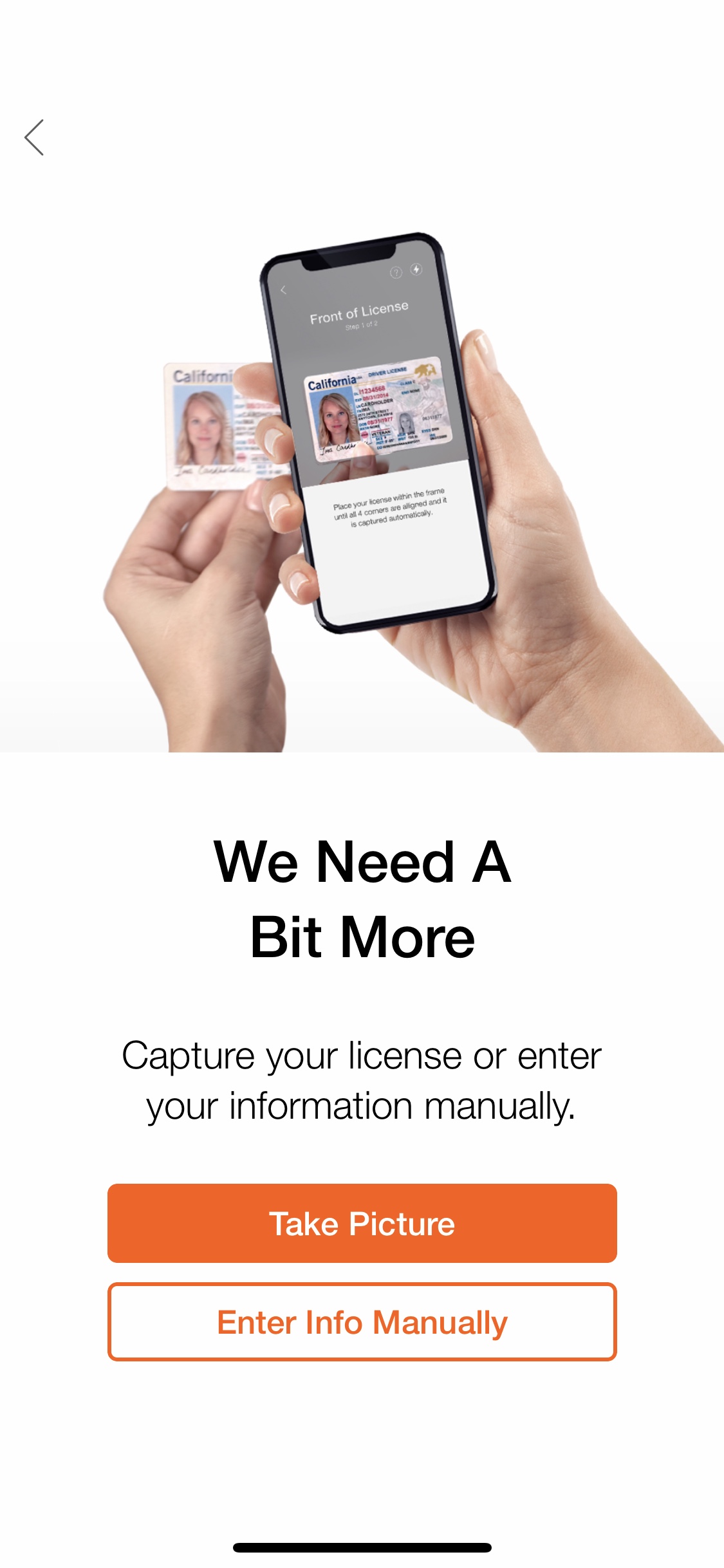

Step 2: Create your account and scan your driver’s license

Additional info like your social security number and proof of address may be necessary.

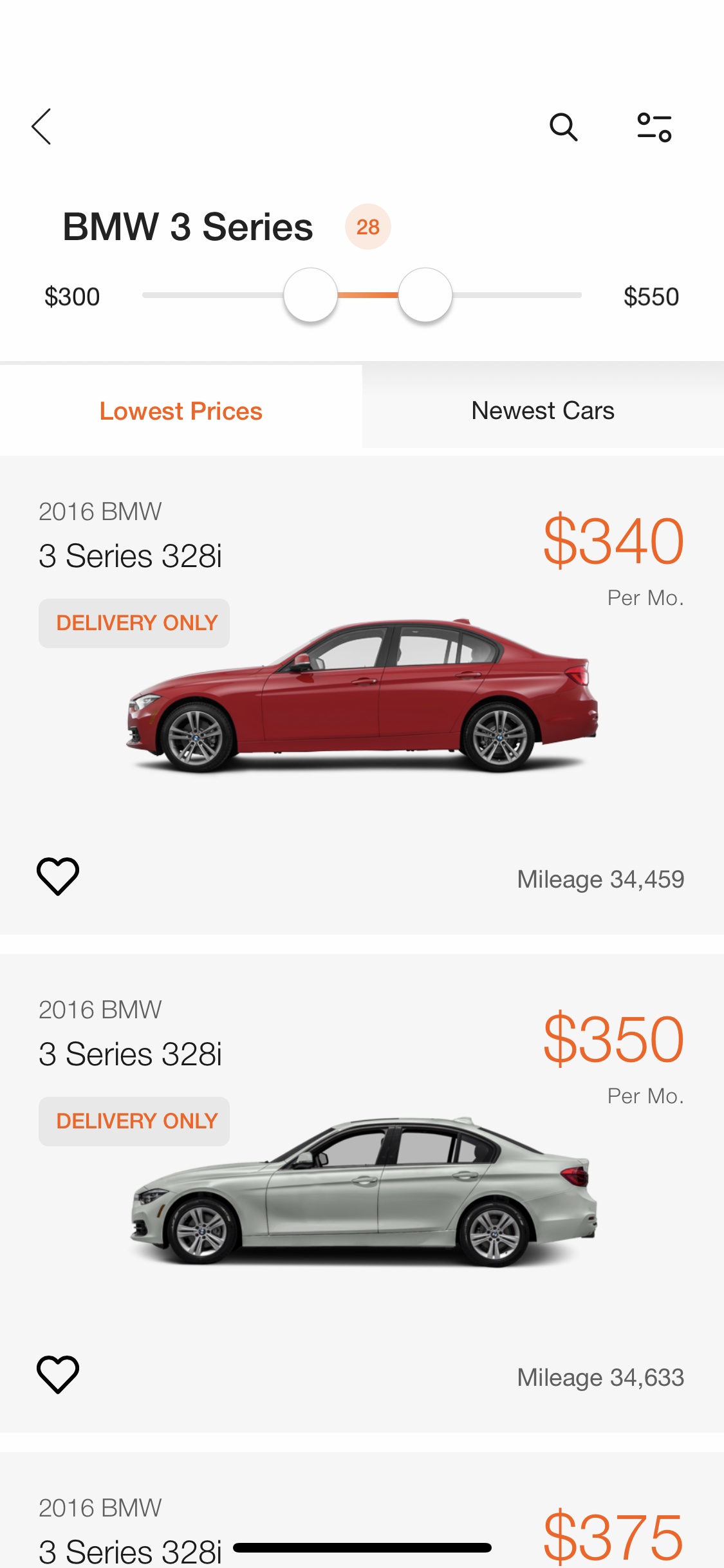

Step 3: Start browsing through cars

You can search through anything from price to brand and ❤️ your favorites along the way.

Step 4: Find the car of your dreams!

Once you’ve found the one, you can pick it up or even have it delivered to you!

Step 5: Drive worry-free and turn your car in whenever you’re done!

Car buying has literally never been so easy. Though it sounds too good to be true, it isn’t. Fair is a hot ticket item because of its convince as well as its trustworthiness. Try it yourself and see what all the fuss is about—you’ll thank us later.

This Is How You Celebrate a Raise Without Offending Anyone

Sharing is caring-- usually.

Celebrating a raise is not like celebrating your birthday—you can’t invite everyone to the party. But after months—years, even—of hard work, how do you give yourself a well-deserved pat on the back without making others feel less than stellar about their own work? Promotions at work are public knowledge, and most co-workers will be happy for your deserved success. However, raises, bonuses, and the like, are often not shared for understandable reasons.

Here’s how to celebrate your well-deserved success without bumming out the person typing away next to you at work.

USE DISCRETION

There are people in your life who will always be happy for you, but total transparency when it comes to talking money with co-workers is tricky. It’s also still considered taboo in most workplaces. There are parity arguments to be made for salary transparency, but things can get awkward pretty fast when co-workers find out you’re making more than them. Even if it is deserved, you don’t want to become the pariah of the coffee pot talk.

"Things can get awkward pretty fast when co-workers find out you’re making more than them."

Tweet this.

If there is someone in your office with whom you engage in reciprocal sharing, meaning you share you salaries with each other, then by all means share! Research has shown that transparency among female co-workers helps in salary negotiation.

However, you don’t want your salary to become the point of reference for raise meetings. (Nor should anyone use, "Well, I know that Jenny makes X,” as an argument for a pay increase.) Though perfectly legal, it may cause your boss to think you’re unprofessional and could affect future raises. There are subtle differences that contribute to pay variances, unseen by co-workers but acknowledged by bosses.

If you decide to share, it’s like Pandora’s box: That information is out there and alive. There’s no telling who will find out or what damage it might do, and, ultimately, your boss is the one who has to deal with the aftermath.

DON'T SHARE ON SOCIAL

Sharing is caring—most of the time. If you and your closest head out to dinner and drinks to toast your successes, consider resisting the urge to share on social. Most of your co-workers, and likely your boss, follow you. While you should be able to revel in your raise, remember there are polite ways to do so.

If you do want to share, consider a post that toasts to all the successful women in your life. Post a specific honor or milestone you reached at work that’s not tied to a dollar sign. You should be proud of your hard work, but keep in mind whose eyes are on your social.

TREAT YOURSELF

But only once (okay, twice). You deserve to have a little fiscal fun, but you don’t want to celebrate your raise by upgrading your life. In fact, financial advisors agree that it is a mistake to upgrade as your salary increases. The best way to celebrate your raise is by banking on your future.

That means saving up for bigger life purchases. The average pay raise in both 2014 and 2015 was 3%, and 2016 is following suit. You may not be able to purchase a home by 30, but you definitely won’t be looking into mortgage options if your rent increases every time you are rewarded at work. Be smart. Be save-savvy. Get that bag you’re eyeing, and then plan on contributing more to your 401(k).

The original version of this article appeared on My Domaine.

MORE FROM OUR BLOG