LLC vs. S Corp: Which Is Best for Small Business Owners?

Picking the right one is essential.

Photo by Marcos Paulo Prado on Unsplash

As a small business owner, you’ve probably heard the words LLC and S Corp floating around. And you probably need to decide which one to form. And while legal structures aren’t the most exhilarating topic, picking the right one is essential for your business.

Deciding if you should go LLC or S Corp starts with knowing the differences between the two and how each one will impact your business. Read on to learn everything you need to know about LLCs and S Corps.

LLC vs. S corp: The basics

As a small business owner, the two legal structures you’ve probably heard the most about are single-member LLCs and S Corps. Before we talk about the difference, we got to get one technical thing straight.

Technically, an S corp isn’t a legal entity but a tax election. It’s confusing but bear with us.

The IRS assigns every business structure a default tax treatment...which is just a fancy way of saying that the IRS decides how each business structure is taxed.

Single-member LLCs are automatically taxed like sole proprietors unless they ask otherwise. That’s where the S corp election comes in.

You can ask the IRS to tax your single-member LLC as an S corp, which means that the IRS won't tax you under the rules of a sole proprietorship; they’ll tax you under the rules of an S Corp (which we'll talk about later).

To keep things simple in this article, we will be referring to:

Single-member LLC as an LLC

Single-member LLC electing to be taxed as an S Corp as an S Corp

Taxes

The biggest difference between an LLC and an S Corp is how you’re taxed.

An LLC and S Corp are both pass-through entities. That means that all the profits from the business are passed on to the owner’s tax return. Unlike a C Corp, which has to pay corporate taxes, your business doesn’t pay any taxes. Instead, you, the owner, do.

How LLC taxes work

The IRS automatically taxes an LLC like a sole proprietorship. Under this tax treatment, you’ll pay two types of taxes:

Self-employment tax - 15.3% of 92.35% of your profit. Self-employment tax goes towards your Social Security and Medicare.

Income tax - Varies based on your tax bracket.

You probably know that self-employment tax is a killer, and it’s why taxes feel so much higher when you’re a small business owner than an employee.

When you’re an employee, your employer pays for half of this 15.3% through payroll taxes, and you pay the other half, which is deducted from your paycheck.

When you’re a small business owner, you pay for all of it yourself.

How S Corp taxes work

When it comes to S Corps, there’s one major tax difference: S Corp owners don’t pay self-employment tax on the business’s profits. They only pay income tax on the profits.

It sounds great, we know. But there’s a catch. S Corp owners are required to pay themselves a reasonable compensation via payroll. And your employee wages are subject to FICA payroll taxes.

FICA payroll tax is 15.3% of your employee wages. Yes, that’s the same amount as self-employment tax. But, the difference is that your business pays half of that (7.65%) through employer payroll taxes, and you pay the other half (7.65%), which is deducted from your paycheck.

You pay the equivalent of self-employment tax, but only on your employee earnings.

There are a few other things to know about S Corp taxation:

Your payroll taxes and the salary you pay yourself are a tax write-off, which lowers your taxable profits.

There’s no federal guideline for reasonable compensation, and we recommend chatting with a tax professional about how much to pay yourself (p.s. Collective can help with this!).

You’ll also have federal and state income tax withheld from your paycheck.

Your income tax will include your employee wages and the profits from your S Corp.

Tax savings: LLC vs. S corp

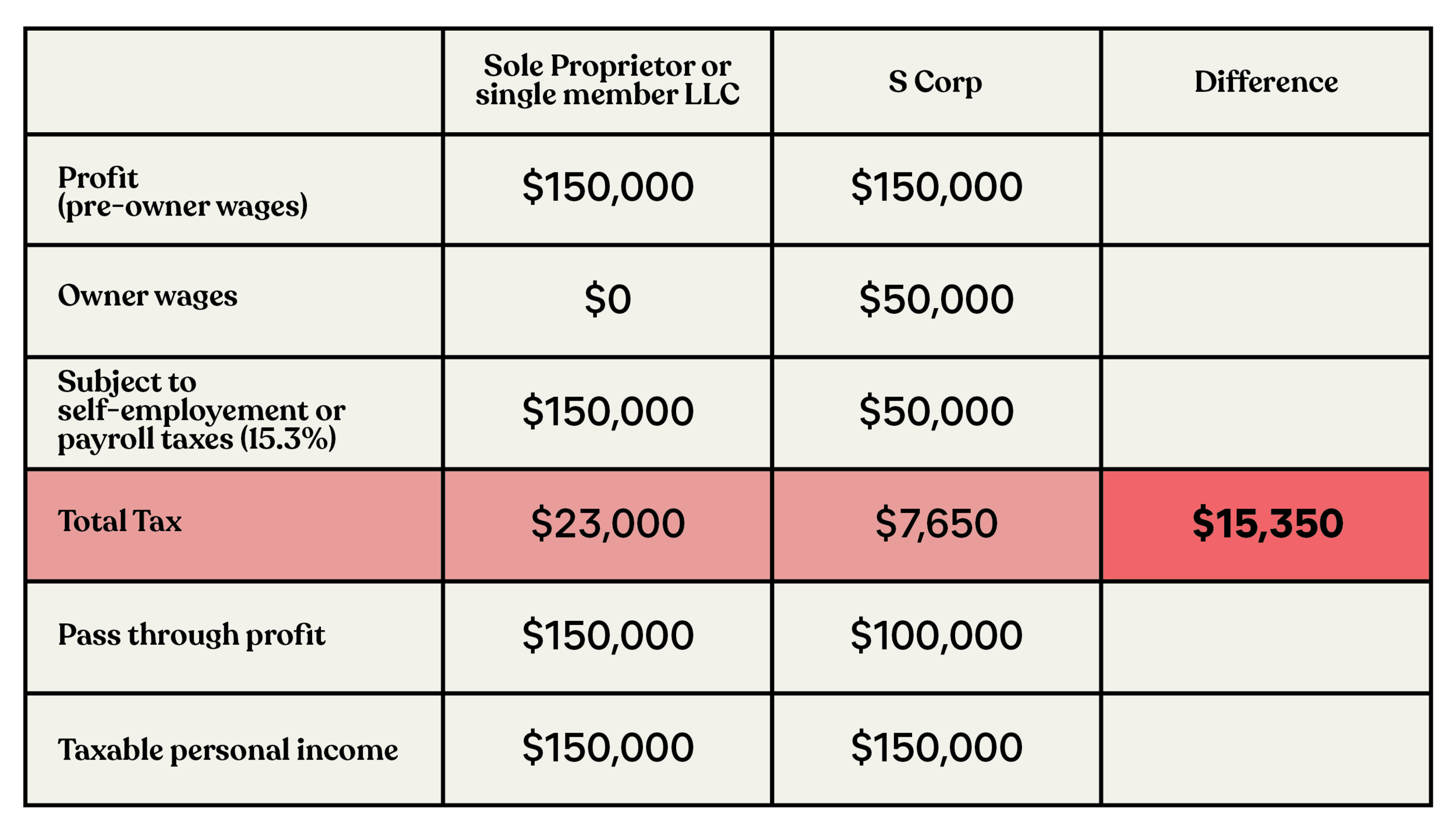

Let’s do an example to compare the taxes a small business owner would pay as an LLC and S Corp. We’re basing this example on a small business owner who earns $150,000 annually in profit and, who as an S Corp, pays themselves a $50,000 salary.

In this example, the business owner could save $15,350 by switching to an S Corp! Keep in mind that these tax numbers don’t include income taxes or state taxes, which will vary based on your tax situation.

If you want a personalized comparison of how much you could save with an S Corp, check out Collective’s tax savings calculator.

Additional costs

S Corps cost more money to run than an LLC. Here are some of the additional costs associated with an S Corp:

Payroll service fees

You 100% don’t want to do manual payroll yourself. Manual payroll involves many percentages, tax calculations, quarterly and annual forms, and ongoing payments to the IRS. If you calculate your payment wrong or miss a deadline, you’ll be subject to a penalty and pay interest on underpayments that you made.

Trust me. It’s way more work than you want to deal with. Instead, you can use a payroll service that runs payroll for you and takes care of all your tax payments and paperwork. Our favorite payroll service is Gusto, which is perfect for S Corp owners.

But like most magical things that do all the work for you, Gusto isn’t free. Gusto will cost you $45 a month to run payroll (unless you have a Collective membership, which includes a free subscription to Gusto).

Bookkeeping costs

The days of doing your bookkeeping via a shoebox full of receipts are over. As an S Corp, you’ll need to get serious about your bookkeeping and use a legit accounting program, like QuickBooks Online. The most basic QuickBooks Online subscription will cost $20 per month (Collective members also receive a free subscription to QuickBooks Online).

Tax preparation fees

When you’re an LLC, you report your business’s income and expenses on your personal tax return, and you only file one tax return.

As an S Corp, you’ll file your personal tax return plus a corporate return called the 1120-S, U.S. Income Tax Return for an S Corporation. Filing this extra return will set you back several hundred dollars.

Annual state registration fees

Depending on where you live, you might have to pay a yearly registration fee for your LLC and S Corp. Fees range from $20- $800 per year.

Cash Flow

S Corps require steady cash flow.

Cash flow is the money that comes in and goes out of your business in a given period. While cash flow includes your income and expenses, it also includes transferring money to your personal account, debt payments, and savings.

Sometimes, businesses are profitable but don’t have enough cash flow to sustain their operations because too much money is going out to cover debt, taxes, or owner pay.

With an S Corp, every time you run payroll, you pay a portion of your taxes in real-time, both as the employer and employee. This means you need to have the money available for your salary and payroll taxes every month.

Liability protection

The good news is when it comes to liability protection S Corps and LLCs offer the same level of limited liability protection to their owners. That’s because an S Corp is an LLC taxed under the rules of an S Corp.

Limited liability means that if your business is sued or can’t pay its debt, creditors and claimants can’t go after your personal assets, like your house or car. While there are some exceptions to this rule, generally, this is the case.

Which one is best for you?

The truth is, the less you earn, the less beneficial an S Corp will be for your taxes. Even if you have some tax savings, the additional costs might eat up all your tax savings. Then you just have more work to do with no payoff.

Our general rule of thumb is that you will benefit from an S Corp if:

You’re earning more than $80,000 in profit each year

You can pay for the additional costs of running an S Corp

You have the cash flow to make regular payroll runs

Now that you have all the deets about LLCs and S Corps, you can make an intentional decision about which entity to form. Still not sure if an S Corp is right for you? Check out Collective’s tax savings calculator and see how much you could save with an S Corp.

C&C readers can enjoy 2 months of a Collective Membership at 50% off with this exclusive sign-up link.

About the Author: Andi Smiles is head of content at Collective. She started her career as a small business financial consultant, teaching businesses-of-one to take control of their finances to build more authentic and sustainable businesses. She’s helped thousands of self-employed folx organize and understand their business finances while also uncovering their emotional relationship with money.

MORE ON THE BLOG

3 Money-Saving Tax Tips for Small Businesses

Here’s what a tax strategist recommends.

Photo: Ivan Samkov from Pexels

If you were to ask anyone who just launched a business, start-up, or product in January of 2020 where they’d be in a year, I’m sure most would have had an optimistic answer and replied with an answer along the lines of “hoping my business will take off.” Unfortunately, that was in a time before COVID. Now, an estimated 60% of small businesses have closed in the past year, and the impact the pandemic has had on small businesses is absolutely heartbreaking. I myself launched a small business right before the pandemic hit and completely understand the challenges that most founders face. I am one of the fortunate ones who has been able to maintain my business through an online presence and very dedicated clients.

Most of my clients are also small business owners who faced the same challenges as me in 2020, and as a tax strategist and owner of Your Tax Coach, it’s my goal to help them navigate PPP loans, EIDL grants and loans, the COVID relief bill, a change of presidential administration, and now, tax season. You’re probably wondering “what is a tax strategist” and “what exactly makes you any different from an accountant?” Simple, my goal is to save business owners like you tens of thousands of dollars on your tax returns, while also relieving your tax-related stress and anxiety through consistent, easy-to-understand communication.

An accountant will keep records of your finances throughout the year and keep your tax returns compliant. They don’t look for different strategies to apply when filing your taxes and their goal isn’t to save you money, especially if you are a small business owner. For example, did you know that you can claim your cell phone bill, internet, business coaches, courses, conferences, books, magazines, coworking spaces, website design, and even those holiday cards you sent to clients on your tax returns? Some tax strategies also include paying your children and paying yourself rent through your business. Accountants aren’t going to include claims like these because it takes time and documentation to implement.

Now, this is how I saved my clients over $4.5 million in 2020 on their tax returns, and what I recommend you should do. Here are my top three tips for all small business owners filing their taxes this year.

1. If you profit over $40,000 a year in your business, you should probably be an S Corporation, not a sole proprietorship or LLC.

It’s easy to assume just because you are a one-woman show running a small business that you don’t necessarily qualify to be considered an S corporation. Although S Corporations require an application and documentation, this is an easy way to save up to $22,000 in taxes each year.

2. Know your numbers, and update your bookkeeping monthly.

Track, track, track! Staying on top of your bookkeeping each month (or, better yet, each week) makes it so much easier to know how much you are profiting. Waiting for your accountant to figure it out a few weeks before taxes are due will not only be a pain but will also likely result in you overpaying in taxes.

3. Have a tax strategy session with a tax strategist (you’ll be surprised to know that you’ve been overpaying for years).

Again, a tax strategist is entirely different from your accountant, and meeting with me or another tax strategist, you’ll quickly realize you’ve been overpaying taxes for years.

Bonus tip: Have a home office? Make sure you’re getting the maximum home office deduction. (There are multiple ways of calculating it.)

Most small business owners and entrepreneurs don’t have a traditional office space that they’re renting. We all know that you're really working in some small makeshift office, which, technically speaking, is still considered a home office. If there is a desk, computer, and chair present, you got yourself an office. Make sure you know to deduct this when you are filing your taxes.

Overall, a tax strategist is going to go above and beyond to save you as much as possible in taxes. My biggest recommendation is to invest in yourself and your business and hire someone who is going to ensure that filing your taxes is a fun and easy process, instead of dreading it. Your tax strategy should be seen as a MUST, not a plus.

"Invest in yourself and your business and hire someone who is going to ensure that filing your taxes is a fun and easy process, instead of dreading it."

—Barbara Schreihan, Founder of Your Tax Coach

About the author: Barbara Schreihan started her career journey working at many different accounting firms, and she quickly noticed that her firms were lacking in customer service and tax strategies. She decided to take a risk of her own and start her own accounting business with the main goal of implementing strategies for clients to reduce the tax impact on themselves and their businesses. She now provides clients her services through tax strategy, tax preparation, and business intensives. Her goal is to customize either of these three services and implement strategies for clients to reduce tax impact for their business. For more information, be sure to follow her on Instagram or visit her website.

Love this story? Pin the below graphic to your Pinterest board.

MORE ON THE BLOG

13 Things You Didn't Know You Can Write Off

It’s all about those deductions.

Photo: Smith House Photo

The world may be turned upside-down right now (thanks, COVID-19) and Tax Day has been moved to July 15, but we suggest you make the most of your quaran-time and get those taxes done!

We’re here to help ease some of the stress before you start scrambling to collect receipts and scour all your bank statements from the past year. Sure, taxes can be a drag (or something to look forward to if you know you’re bound to get a tax refund), but if you’re like most independent contractors or freelancers, you might owe a hefty amount of money to your state and the IRS.

However, there are so many things taxpayers fail to claim on their yearly taxes that could definitely help ease the fees that you owe back. To help you get a tax break, we’ve made a list of tax write-offs that many of us fail to claim and you may be overlooking, too.

Out-of-Pocket Charitable Deductions

If you contribute to your community and help with charitable work, or give charitable donations that include out-of-pocket costs, your good deeds may be rewarded with a tax write-off. If you’ve donated food to a soup kitchen, bought clothes for a women’s shelter, or even driven your car for charity, make sure to keep those receipts as they can work as a great tax deduction.

Home Office Costs

Now that we all WFH this deduction may be more useful than ever. So, your bed may not count, but if you use part of your home regularly and exclusively for business-related activity, the IRS lets you write off associated rent, utilities, real estate taxes, repairs, maintenance, and other related expenses. So if you are one of the lucky few working in your pajamas in the luxury of a home office, this year is to make the most of this write off.

Moving Expenses for Your First Job

Once you’ve moved past the job hunting phase and have landed your dream job on the other side of the town, or even the other side of the country, you’ll need to move closer to your job. If you’re moving farther than 50 miles away, you can write-off your moving expenses this season, including transportation.

Child Care Credit

If you have to leave your child, who is filed as your dependent under 13 years of age, with a sitter or at daycare while you’re at work, your child care expenses can serve as a tax credit, up to $3,000.

"Smart" Tax

If you are going back to school to sharpen your skills, are taking special courses for work, or have bought literature (books or magazines) that are relevant to your field of work, make sure to mark these as your “smart taxes.” Which, goes to show that any money that you spend on your education is always an investment.

Baggage Fees

Did you know you can get those annoying baggage fees right back into your pocket? Save the airline receipts from any checked baggage that you had to pay for, and mark them as a deduction when you file.

Energy-Saving Home

If you’re eco-savvy and have turned your house into an eco-friendly home in the past year, you can be rewarded with a great tax credit for your improvements. We know you went for paperless last year, but in this case, you might want to keep those paper receipts.

Financial Advisor/Accounting

If you have a financial advisor, tax preparer, or even paid to use a program like Quickbooks or Intuit to manage your finances and taxes, you can deduct those fees for the year in which you paid for them. If you still have your receipts from paying your preparer or the programs that you bought, make sure to include those in on your deductions!

Healthcare for Self-Employed

If you’re a boss lady of your own and are paying your own bills, like your own healthcare, then make sure to include your medical and dental bills in your deductions, as well as those bills for your family and dependents.

Phone Bill

If you’re always using your phone for work and have not yet put your phone bill as a part of your deductions, you have been missing out on getting some money back! Make sure that you keep track of what calls are work and which calls are personal as those will be very important to differentiate when it’s time to file.

Fostering a Pet

Some people can’t commit to adopting a pet, but if you were able to foster a pet in the last year, you can include expenses from the pound, vet, and even food when you’re filing for taxes. A good tax deduction can come from your charitable work.

Jury Duty

Jury duty may be a drag, but the pay you get from the court is tax-deductible if it was turned over to your employer. It all comes full circle!

Bad Luck, Accidents, and Damages

There are things that are simply out of our control, like your car breaking down, your roof caving in after a storm, or even you actually breaking a leg after your colleagues told you to break a leg at your client meeting. If you don’t have insurance and you have to pay out of pocket for repairs and medical bills, you can include them when you’re filing for taxes as a tax deduction. It’s not all bad luck after all!

This post was originally published on February 11, 2019, and has since been updated.

Know Your Worth, Then Add Tax: The Multi-Hyphenate's Stress-Free Guide to Doing Your Taxes

“There are talkers and doers, and people respect action the most.”

With the current COVID-19 situation, we know these are difficult times for both self-employed individuals and small businesses. In an effort to support and empower our self-employed community, we’re sharing step-by-step guidance on how to easily and affordably file your self-employed taxes with TurboTax.

The rise of the gig economy has given us multi-hyphenates, a.k.a. people who’ve built successful careers out of juggling more than one job at a time. In fact, more than eight million people—about 5% of the workforce—have more than one job. And, fun fact, the average self-made millionaire has at least three streams of income—65% have three streams of income, 45% have four, and 29% have five or more.

Of course, being a solopreneur with multiple side hustles is exciting—after all, you’ve mastered the art of multiple streams of income!—but that means tax time can be a bit complex (hello, 1099s galore).

In anticipation of the new extended tax deadline, July 15th (a.k.a. this year’s Tax Day), we sat down with Lindsay Luv, a multi-hyphenate DJ, influencer, sommelier, and more, to find out how TurboTax Self-Employed can help multi-hyphenate solopreneurs file their taxes with confidence. With the changing COVID-19 situation, these are unprecedented times. Find out all the new tax changes and understand what the Coronavirus relief bill means for self-employed taxpayers by visiting the TurboTax blog.

Be sure to keep reading until the end for the chance to win a FREE TurboTax Live Self-Employed product code (valued at $250, includes ad-on services).

Join the solopreneur tax conversation by using the hashtag #solopreneurtaxtips. Don’t be shy! We all have questions about taxes (especially now), share yours on social too!

CREATE & CULTIVATE: As a DJ, music supervisor, influencer, and sommelier, you're a modern multi-hyphenate with many careers intersecting at the same time. What advice do you have for those reading this who don't have their eyes on one career path and feel split into different areas? How do they go about it?

LINDSAY LUV: I believe expanding your brand should feel natural. If you find yourself drawn to another potential career path, perhaps think about what you’re already doing and how it can lend itself to the other. I never say I am “switching gears” because that sounds like you are closing the door on what you have already done; rather I say I am “expanding my brand” because that simply opens more doors. You never lose the skills you have already built, so why not develop and share more as you go!

Also, the difference between those who say they are going to do something and those who actually take the plunge is vast. Sometimes you need to just rip the bandaid off! When it came to getting certified as a sommelier, I simply signed up and paid for the class and then showed up: that's half the battle! Wine goes hand in hand with music and events and sharing my finds (i.e., influence) so I am always thinking of ways to overlap my skill set. There are talkers and doers, and people respect action the most.

With your many careers, it’s safe to say that you’ve mastered the art of multiple revenue streams—and we here at Create & Cultivate love a woman who isn’t afraid to shy away from wanting to build a profitable business—So, can you tell us, why is it important to diversify?

With humans living longer lives they are actually predicting many of us will indeed have multiple professions across a lifetime! Just like relationships change and grow over time so do our interests and skill sets, and it is important to check in with yourself each step of the way and reflect on how your profession is serving you and how you are serving it.

I am someone who always loves to be steps ahead. If I see a door starting to close (whether by choice or otherwise), I am thinking of which ones I can open: which parts of my career, relationships and learnings can I utilize for a new profitable task.

Working for yourself means you have to hustle and keep up with both your own goals and the demands of the market. Since I started working for myself, so many elements keep changing from social media to client’s needs and unless you are evolving with them you are lagging behind (and losing money in doing so.)

As we’re sure you can attest, you have to fall in love with the numbers when you’re running your own business, especially when that involves managing multiple income sources—What are some of the hardest money lessons you've learned along the way? And what are some of the tools you use to stay on top of your business financials?

As my own agent, sometimes it is awkward to chase down payments due. You run that line between wanting to seem relaxed with clients, but also simply needing to be paid for work done. Sadly, sometimes clients will put you in an awkward spot with pay delays or trying to pull out of things last minute, etc. I find it is helpful to have an assistant oversee the communication about payment with clients so you don’t always have to be the face of the tedious back and forth that can occur.

I also leverage technology to remind myself of when payments are due and space out reminders to follow up. I use resources and tools such as QuickBooks Self-Employed to keep myself organized year-round, keeping track of my personal and business expenses as well as receipts. I can import all my business expenses to TurboTax Self-Employed making taxes a breeze! I like their Live product since it brings the best of both worlds, the ease of technology plus the human touch and expertise of a real tax expert. At the end of the day, you want to make sure you feel confident you are getting your self-employed taxes done right and are getting every dollar you deserve.

You've been very smart and savvy with your business and it's been incredibly profitable—Where do you think is the most important area for a solopreneur or small business owner to focus their financial energy? Why?

The reality is you should focus your heaviest energies on hustling and maintaining work wherever you are gaining the most momentum. For me, that has always been DJing, but now, with my social media growth, I am seeing new profitable opportunities arise in a variety of areas outside of the decks, so it has my wheels spinning on how to grow those. Keep pushing where the money already is, but reach out for everywhere it could be!

Do you think you have achieved financial freedom? If not, what is preventing you as a self-employed professional to get there? What would you need to get there?

Yes! I have been self-employed and my own agent for over ten years, which feels like freedom to me. I am able to comfortably afford a lifestyle I feel good about and contribute to my family, which is the best you can hope for. I also balance between being a full-time mom and a working mom by accepting quality over quantity job opportunities.

With that being said, human nature is to want more, so in some ways, working for yourself is always complicated and you never can fully relax into a full feeling of freedom. It is important to never get too comfortable because being self-employed always means the onus is on you to hustle and grow. While a lot of work does come to me after having established myself over a decade, it is important for me to touch base with all my clients regularly and share my successes; plus, remind them of all we have done and what we can do going forward!

What are you most excited about for your business in 2020?

I have been putting feelers out for so many possible brand expansions and seeing which ones stick. I am never afraid to reach out to great contacts or throw out ideas and see which ones materialize, as I believe both my business acumen and skillset can lend themselves to a variety of areas, from public speaking, hosting, podcasts, music supervision, influencer collaborations, consulting, sommelier opportunities, and more. Not every one of these will become the next big (or most profitable) part of my brand, but without opening up to a multitude of ideas and putting some muscle behind them you won’t know which one could and will!

Our friends at TurboTax were nice enough to share a giveaway with Create & Cultivate readers so you can file your taxes for FREE this season—all from the comfort of your own home!

30 readers will receive a FREE TurboTax Live Self-Employed product code (valued at $250, includes ad-on services). Simply fill out the form below to enter to win. The winners will be chosen randomly and contacted via email. Good luck!

TurboTax Live combines the ease and technology customers know and love about TurboTax with on-demand credentialed CPAs, Enrolled Agents, or Tax Attorneys, for ultimate convenience and confidence. You can connect live to a team of real credentialed tax experts in English or Spanish, for unlimited tax advice and a final review before you file.

Giveaway now closed, thank you for entering! We will email the winners directly.

15 Headache-Preventing Tax Tips You Can Use Right Now

Tackle tax season like a pro.

Photo: Smith House Photo

Overwhelm. Cold sweats. Glazed-over eyes.

Every year, these are the emotions felt by many of us come April 15, a.k.a when it’s time to file our tax returns. It seems like tax season sneaks up on us every year, and no matter how hard we try to be proactive, to plan and prepare, most of us are left doing everything at the last minute.

So to help you get a handle on your taxes this year—and better prepare for tax season next year—we asked Natalie Asghari, a CPA at NA Business Advisors and CPAs, Inc. (NABA), to share tax tips that we can all implement into our financial life. Whether you’re employed full-time, self-employed, or working several side hustles, scroll on to find out how to get your 2019 taxes in order.

Tips for Everyone

1. Gather all your records in advance.

Gather all documents or forms you’ll need when filing your taxes: receipts, canceled checks, and other documents that support income or deductions you’re claiming on your return.

Always keep originals. Make copies of all valid documents that you will provide for filing.

Group together documents regarding mortgage interest payments, property taxes, charitable gifts, medical bills, and any other items that may count as deductions.

2. Keep track of important records.

The best way to do this is by staying organized throughout the year. Don’t wait until the end of the year to consolidate your documents. Gathering information at the beginning of the year will save you time and reduce the chance of omitting information and amending tax returns when it actually comes time to file.

Keep track of your expenses on a quarterly or monthly basis by record keeping, especially if you are self-employed.

Keep a record of tuition, books, computers, and fees that you pay because you may be able to claim an education credit or deduction for the amounts you pay.

Records need to be kept for at least three years (four for state of CA) from the date you filed the related income tax return. You should keep a copy of your actual tax returns, W-2s, 1099s, etc.

3. Decide how you’re going to file.

Be sure to consider different tax statuses if you are eligible for more than one. For example, if you’re married and can file either jointly with your spouse or separately, be sure to consider both options. This might be something for you to investigate throughout the year, especially if your circumstances change.

4. Review! Review! Review!

Don’t rush. We all make mistakes when we rush. Mistakes will slow down the processing of your return. Be sure to double-check all Social Security numbers and other personal information on your return. Remember, you are the taxpayer signing the return and you are responsible for any missed information.

5. Keep up-to-date on tax laws.

While it might be a good idea to get expert advice regarding tax law, you should also keep an eye on the news for anything that might affect you or your business. A well-informed client can often help an accountant give the best advice, so make sure you know about any changes in tax provisions that could apply to you. Ask questions if you believe something you read or heard may affect you.

6. Hire an accountant or professional tax preparer to do your taxes.

Because constant changes make the tax code more complex each year, you may be more comfortable–and able to use tax savings strategies, pay fewer taxes or receive a bigger refund–if you have a professional prepare your returns.

Tips for the Self-Employed

7. If you are self-employed, you may have to make estimated tax payments.

This applies even if you also have a full-time or part-time job and your employer withholds taxes from your wages. Estimated tax is the method used to pay tax on income that is not subject to withholding. If you fail to make quarterly payments, you may be penalized for underpayment at the end of the tax year.

8. Keep a good record of income and expense for your business.

To be deductible, a business expense must be both ordinary and necessary. An ordinary expense is one that is common and accepted in your field of business. A necessary expense is one that is helpful and appropriate for your business.

9. Set up a retirement plan.

A retirement plan not only benefits you later in life, but it is also a method of reducing your current tax liability, and often reducing taxable payment on a set amount of money at any point in time. Your taxable income at retirement will most likely be a lower bracket than your working income.

10. Don’t miss the health insurance deduction.

The deduction is for medical, dental or long-term care insurance premiums that self-employed people often pay for themselves, their spouse and their dependents.

11. Deduct transportation costs.

You should be able to fully deduct any transportation costs (plane tickets, taxis, airport parking, etc.).

If you’re driving to meet a customer or conducting business travel, you will need to keep a schedule/log with dates, mileage, etc. If your trip was primarily for business purposes, you can deduct certain expenses, such as hotel costs for any business days; if you combine work and play, you can’t deduct lodging and meals for your personal days.

12. Deduct meals and entertainment for clients.

Paying for meals and entertainment for current or potential clients can be deductible, as long as the meals or entertainment was directly related to and associated with the business. Be sure to keep records such as the date, the purpose of the meeting, and the parties involved.

Tips for Employees/Employed Individuals

13. Collect all your W-2s and 1099s.

You’ll need these to file your tax return. Check and make sure your withholdings from paychecks are correct based on your situation–especially if you had life changes such as purchasing a primary residence, getting married or having a child.

14. Pay estimated taxes.

If you do not pay your tax through withholdings or do not pay enough tax that way, you might have to pay estimated taxes or you may have additional tax liabilities when it comes time to file your tax returns. You may have to pay estimated tax if you receive income such as dividends, interest, capital gains, rent, and royalties.

15. Deduct job-related expenses.

If you paid for expenses related to your job during the tax year, many of these expenses may be eligible to be deducted on your return if they are unreimbursed by your employer. Deductible unreimbursed employee expenses generally fall into one of two categories: job-specific expenses and travel-related expenses. Some examples of job-specific expenses are protective clothing required in your work, such as hard hats, safety shoes, and glasses; physical examinations required by your employer; dues to professional organizations and chambers of commerce; licenses; and regulatory fees, to name a few.

Don’t let tax season scare you into an anxious state this year. Instead, spend some time, plan ahead and follow the tips outlined in this article. I believe you can make it through tax season without pulling out your hair. Now, I ask you, what tip will you be following this tax season?

This story was originally published on February 12, 2016, and has since been updated.

Brittney Castro is the Founder & CEO of Financially Wise Women, an LA-based financial planning firm for women. She specializes in working with busy, established professional and entrepreneurial women who are passionate about life and want to finally understand money—how to manage it, save it, invest it, and protect it—in a fun and simple way.

Brittney has been featured in the Wall Street Journal, New York Times, CNBC, Glamour.com, Entrepreneur.com, KTLA, CBS, and more. Away from the office, you can find Brittney working out, drinking coffee with steamed almond milk, reading, playing with her fur baby Arya, and of course dancing!

Sign up to receive your Financially Wise Toolkit jam-packed with great tools and resources to help you on your financial journey at financiallywisewomen.com. Follow Brittney @brittneycastro.

6 Ways to Reinvest Your Tax Refund and Make Your Business Profitable

Make your money work for you.

Photo: Polina Zimmerman for Pexels

If you're investing in yourself this year, you should take a minute to think about what that means for your taxes. Don't fret, this is the good kind of tax post. Early bird catches the IRS worm, after all.

And with tax season just around the corner, it's never too soon to give pause on how you're going to spend a refund. While everyone will tell you that year one of being a small business owner is the hardest, during tax season, there are multiple credits you can take.

If you’re in the position to get refund from the IRS, the best decision you can make as a business owner is to put that money to work.

Here is how to reinvest your tax refund. Use these six ways to make sure that year two is golden (or at least in the green).

You’re only as good as your team.

You hear this again and again because the numbers do not lie. It costs you time and money to employ workers who do not work at optimum capacity. According to a study conducted by ADP, engaged employees are 57% more effective and 80% less likely to leave your company. Employee turnover or a disengaged employee can cost you $2,246 per year. To power your bottom line you need to make sure your team is happy and appropriately paid. It might be hard to see the payout to pay your employees more, but it is a long term investment.

The goal shouldn’t be expansion (unless you really do need to add to your team), but reinforcing the team from within.

Know When You Need to Delegate and Let Those Reigns Go

If your tax refund gives you the flexibility to outsource tasks that are eating away at your time, it might be the right time to consider doing so. For instance, if as a business owner you’re attempting to cut corners for the sake of funds, but you’re wasting time in the office sorting, organizing, answering customer support emails, or you’re losing hours in QuickBooks, figure out what you’re costing yourself.

An easy way to do this is decide what (if you were profitable) would you be paying yourself. If paying someone else is cheaper hourly than what you are worth, you’re losing money. Delegate and open up your schedule to focus on other parts of the business that only you can handle.

You’re a valuable asset to yourself, don’t diminish that by refusing to hire or delegate.

If You're Doing It Good, Tech Will Help You Do It Better

Are you a small business without a website? Do you need to update your photography equipment? Investing in foundational elements of your business is key and will take you to the next level.

Beyond the basics, there is life-changing tech for every business. The primary reason most new small businesses fail in the first two years is generally attributed to a lack of marketing savvy.

Companies that make it past the two year mark have found a way to streamline marketing and social media experience- it’s nearly impossible to engage customers without them. And for a time-strapped new business owner

Investing in the right automated marketing tools is one of the best decisions you can make. Research the different options that best fit your business.

Simply Measured, Keyhole, and Sprout Social are three great options worth looking into. There are multiple plans that offer everything from brand monitoring to reporting tools. This tech will also help you analyze where you’re performing best, so you can direct attention into areas that make the most sense to make that money.

Pay Off Business Debt

If you’re racking up points on that AMEX, you might be tempted to take a vacation, but what you should do is pay off your bill. When you pay off your credit cards you are basically making at 13 to 20% ROI, depending on your APR.

Become a Lean, Green, Tax Rebate Machine

If you have the ability to install solar panel, you can lower your future tax bill. The government offers tax incentives for businesses that invest in green technologies.

Businesses can deduct 30% of their solar install cost on their federal taxes. Not a bad break for giving Mother Nature one.

Don’t Be a Drip, Invest in One

One of the secrets of wealthy people is that they don't expect to make all their money in one place. They have multiple investments that bring them cash. If all of your 2018 ducks are in a row, you might consider an investment as a way to double down on your financial security.

A dividend reinvestment plan (DRIP) allows individuals to buy shares directly from a company and to reinvest dividends from those shares automatically. It’s a plan that takes advantage of the power of compounding. Simply put, compounding is the process of earning dividends on reinvested dividends.

With a DRIP, instead of receiving cash from a declared dividend, participating investors receive shares and fractional shares of company stock of equivalent value.

It’s sort of the magic wand in finance, because it is one of the easiest ways to build wealth with a small amount of effort. Check out what DRIPs might deserve your investment dollars here.

This post was originally published on April 5, 2018, and has since been updated.

MORE FROM OUR BLOG